Small Business Corporations and the tax benefits

A Small Business Corporation (SBC) is a type of business entity which is afforded beneficial tax structures from SARS. The intention behind the SBC structure is to assist small / medium businesses in their early stages with preferential tax rates and write off periods for certain assets, which in turn allows the businesses to reach a better profit after tax and ultimately build a stronger balance sheet position in a shorter period than what it would take under normal tax rates.

*Side note: reduced tax rates = lower tax expense for the entity which results in a higher net profit after tax and a greater contribution to retained income for the year.

It is always advisable to consult with your accountant to confirm whether you qualify but at a very high level, if you meet the following requirements there is a good chance that you qualify to be taxed as a SBC.

| 1. | The business must be a registered corporate entity (a company or a CC) |

|---|---|

| 2. | All owners must be natural persons and all owners must not own any shares in another company (and are not members of another business which operates as a CC), for the entire year of assessment |

| 3. | Annual gross income of the entity must not exceed R20 million for the year of assessment |

| 4. | The business may not be a personal services company (you may need to check with your accountant if this applies to your specific business) |

| 5. | Investment income and income received from rendering a personal service cannot exceed 20% of total receipts for the year for the entity |

So let’s have a look at the preferential tax rates for a SBC.

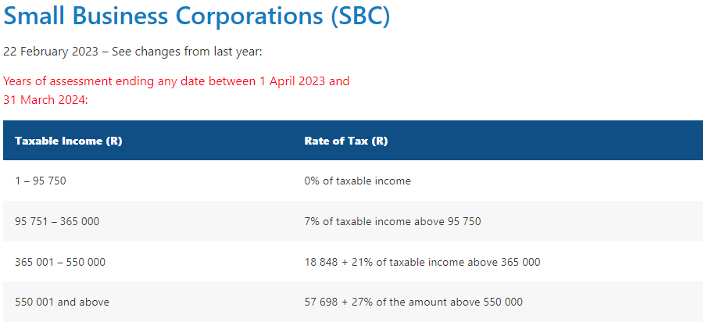

If you qualify as a SBC and meet all of the requirements, these are the current tax rates which apply to all SBCs:

Here are some examples of the tax benefits offered to a SBC for a few taxable income value examples:

Taxable income example | Normal company tax | SBC tax rates | Tax saving for SBC |

R100 000 | R27 000.00 | R297.43 | R26 702.57 |

R350 000 | R94 500.00 | R17 797.43 | R76 702.57 |

R450 000 | R121 500.00 | R36 698.00 | R84 802.00 |

R650 000 | R175 500.00 | R84 698.00 | R90 802.00 |

R950 000 | R256 500.00 | R165 698.00 | R90 802.00 |

Reach out to your accountant to discuss whether the SBC structure can apply to your business as the tax benefits are really worthwhile. If you are needing any help or guidance on this, you are welcome to send us an email on info@la-fin.co.za to set up a consultation to chat through your specific business.

Yours in simplifying finance,

Search

Latest Posts